Deciding when to start collecting Social Security is a significant financial decision for many retirees. While the government allows you to begin receiving benefits as early as age 62, there are pros and cons to this approach.

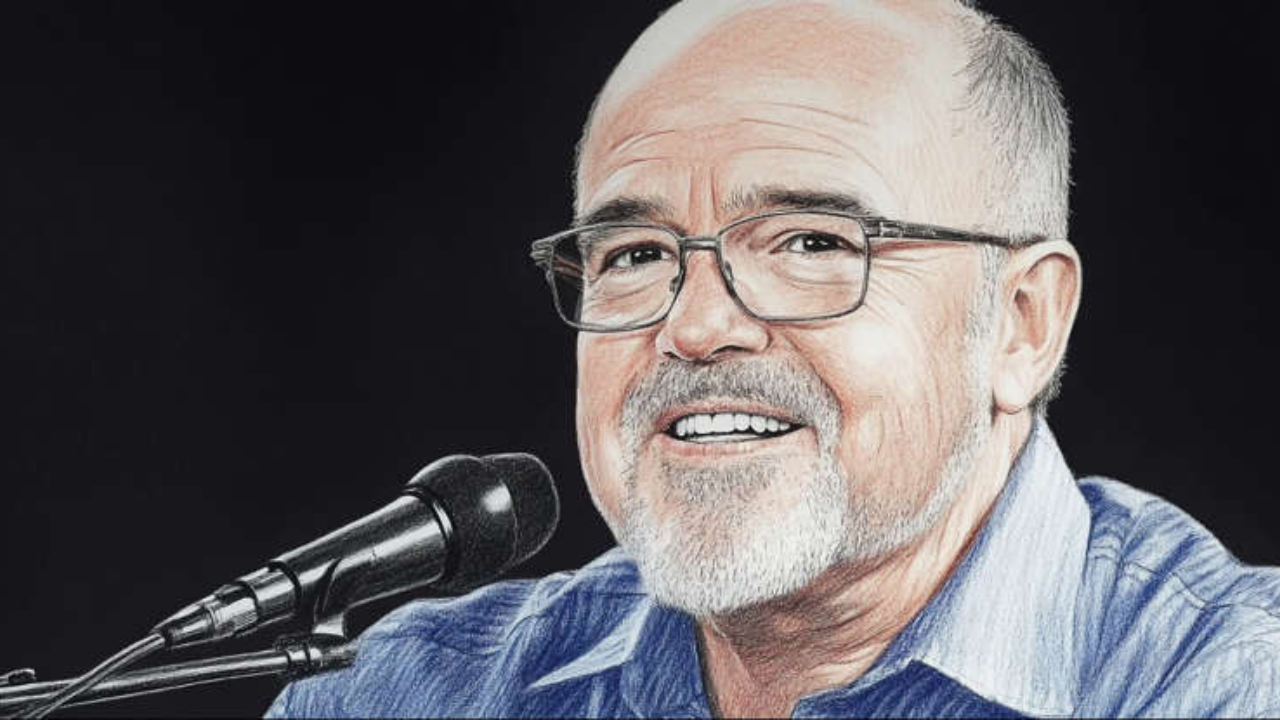

Financial expert Dave Ramsey has often encouraged retirees to collect Social Security at 62, citing both advantages and potential drawbacks.

Ramsey’s advice primarily focuses on how early Social Security payments can be strategically used to improve one’s financial situation.

By investing these early payments into high-performing mutual funds, retirees could potentially create additional wealth.

However, this strategy isn’t for everyone, and it’s crucial to weigh the pros and cons before making a decision.

In this article, we will explore the seven main advantages and disadvantages of collecting Social Security at 62, helping you better understand whether this path aligns with your financial goals.

Why Dave Ramsey Recommends Collecting Social Security at 62

Dave Ramsey encourages retirees to collect Social Security at 62 because it offers an opportunity to start receiving benefits earlier, which can be invested to grow wealth over time.

He suggests that retirees who invest these early payments into high-performing mutual funds could offset the smaller monthly benefit amount by generating significant returns on their investments.

Good News for Seniors: 2025’s Social Security COLA Isn’t As Bad As It Seems

Ramsey believes that starting Social Security at 62 can be a smart financial move for those who are disciplined and knowledgeable about investing.

However, it is important to remember that this approach involves risk, especially if the stock market underperforms or if poor investment choices are made.

Despite these risks, many retirees find that starting Social Security early provides much-needed cash flow or helps them achieve financial stability sooner.

Pros of Collecting Social Security at 62

1. You Get Immediate Access to Funds

One of the primary benefits of collecting Social Security at 62 is that you start receiving your payments right away.

For many retirees, having this steady stream of income sooner rather than later is crucial to covering essential living expenses.

Whether it’s paying off debt, managing healthcare costs, or simply maintaining your lifestyle, early access to Social Security can provide much-needed financial support.

According to a Congressional Research Service report, nearly 30% of eligible workers claim Social Security at 62. This decision is often driven by necessity, especially for individuals who have limited savings or other income sources in retirement.

2. You Can Invest Early Payments for Growth

Dave Ramsey’s recommendation to collect Social Security at 62 centers on the idea of investing the money to generate higher returns.

By investing these payments in mutual funds, you could potentially grow your wealth significantly over time.

The earlier you start investing, the longer your money has to grow, thanks to the power of compounding interest.

While this strategy is not without risk, it can be an effective way to boost your retirement income. However, it’s important to work with a financial advisor to ensure that your investments align with your risk tolerance and long-term goals.

3. Early Retirement Can Improve Quality of Life

For some retirees, continuing to work past 62 may not be physically or mentally feasible. Collecting Social Security at 62 allows you to step away from work sooner, giving you the freedom to enjoy retirement.

Whether you want to travel, pursue hobbies, or spend more time with family, early retirement can provide the time and flexibility to live the life you want.

A study from the Economic Policy Institute found that over 50% of workers over 50 experience physically demanding or hazardous work conditions.

For individuals in such positions, retiring early could be a much-needed break from the daily grind.

Cons of Collecting Social Security at 62

1. Smaller Monthly Payments for Life

The biggest drawback of collecting Social Security at 62 is the reduction in monthly benefits. Social Security uses a formula that calculates your benefits based on when you start collecting.

By claiming benefits at 62, your monthly payment will be permanently reduced compared to waiting until full retirement age, which is typically 67.

This reduction can be significant. Depending on your work history, waiting until full retirement age could result in monthly payments that are 30% higher than if you start at 62.

For those who are financially able to wait, delaying Social Security can provide a more substantial income later in life.

2. Reduced Cost-of-Living Adjustments (COLA)

When you start collecting Social Security at 62, your cost-of-living adjustments (COLA) will also be smaller. COLA is designed to increase your payments over time to keep pace with inflation.

However, if your initial monthly benefit is smaller, each subsequent COLA increase will be based on that lower amount.

Over the long term, this can result in a significant difference in your total Social Security income. While you will still receive COLA adjustments, the impact will not be as great as if you had waited to collect larger benefits.

3. Penalties for Earning Income While Collecting Social Security Early

Another disadvantage of collecting Social Security at 62 is the potential for penalties if you continue to work and earn above a certain income threshold.

In 2024, the Social Security Administration will reduce your benefits by $1 for every $2 you earn over $22,320 if you are under full retirement age.

This reduction is temporary, and once you reach full retirement age, your benefits will be recalculated to account for the deductions.

However, if you plan to continue working in your 60s, it may make sense to delay Social Security to avoid these penalties.

Breaking News: Changes to Social Security Payments This Month—Are You Affected?

Conclusion

Deciding when to collect Social Security is a personal choice that depends on your financial situation, health, and long-term goals.

While Dave Ramsey encourages retirees to consider starting benefits at 62, it’s essential to carefully weigh the pros and cons.

Early access to Social Security can provide financial relief and investment opportunities, but it also comes with permanent reductions in monthly payments and other potential downsides.

Before making your decision, consider speaking with a financial advisor who can help you evaluate the best option for your unique circumstances.